The economic impact of coronavirus on developing countries has been especially harsh. In Sub-Saharan Africa, COVID-19 has seen small businesses—vital to the region’s economy—struggle with a drop in income, tricky containment measures, and a lack of funding.

The United Nations Development Program expects developing countries to see $220 billion worth of income loss due to coronavirus, while analysis by McKinsey suggests as many as one third of jobs in Africa could be lost.

Drew von Glahn, executive director of the Collaborative for Frontier Finance (CFF), found the pending crisis impossible to ignore.

Finding new perspectives

With the help of Elisabeth Prager, an experienced strategy consultant with prior success in the financial services and healthcare sectors, Drew created a bridging facility to support local capital providers in Sub-Saharan Africa.

Throughout the project, Drew and Elisabeth have drawn on the insights they gained studying the Executive Global Master’s in Management (EGMiM) program at the London School of Economics (LSE).

Drew and Elisabeth came to the EGMiM program in 2015. Although Drew was confident in his technical knowledge, he was seeking an opportunity to hear new perspectives.

“Too often we get caught up in the rote of what we do in our job, and our ability to expand and perform better over time is limited,” he reflects.

Drew began his career in corporate banking, before pivoting into impact investment. In 2010, he co-founded Third Sector Capital Partners, which advises nonprofits, government agencies, and impact funders.

Shortly later, he joined the World Bank as a senior advisor, working on social enterprise portfolios across emerging economies. After graduating from the EGMiM, Drew continued his journey by founding CFF—an initiative that aims to increase access to capital for small and growing businesses in emerging markets.

For Elisabeth, on the other hand, the EGMiM offered a great opportunity to explore her next career step.

After working with asset management firms, such as Standard Life and Coutts, for eight years, she wanted to expand her expertise and seek out new career options.

“And it worked,” she says with a laugh. “After graduating, I moved into a boutique consulting firm in London, and then I moved to India to join the Tata Trust, Asia’s largest philanthropic trust, as director of strategy for a cancer care program they were running.”

Tackling a global issue

The EGMiM program laid the foundation for Drew and Elisabeth’s current project with CFF.

Drew’s second year dissertation explored how small, dynamic capital providers can solve certain problems that larger institutions seem unable to address—particularly in emerging markets.

When it became clear that coronavirus would have a profound effect on small businesses in these markets, he realized that working with these smaller, local capital providers would be the most effective way to reduce the pandemic’s impact.

“These providers know the market, they know the risks, they know their portfolio companies—they can see opportunities and risks better than outside investors,” explains Elisabeth.

In spring 2020, Drew proposed a bridging facility to prevent a liquidity crisis for local capital providers and their portfolio of small and growing businesses.

With grant funding from partners including the Visa Foundation, the fund is currently targeted to close around $50 million in early 2021.

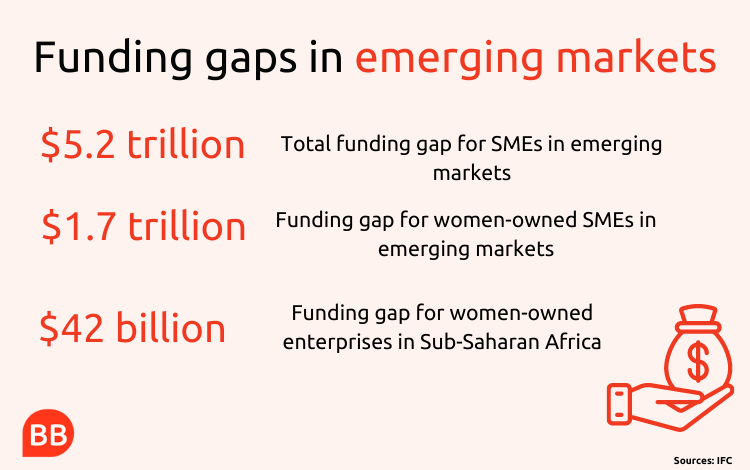

Drew soon asked Elisabeth to join the project, and she jumped at the opportunity. The pair quickly recognized its potential to solve a wider, system issue: the funding gap that small businesses face, and its particularly harsh impact on women.

In Sub-Saharan Africa, women are more likely to be employed in small businesses, but businesses owned by women face a $42 billion funding gap.

“A crisis like Covid impacts women disproportionately, which is why we decided to take this slant of looking at gender,” Elisabeth explains.

Leveraging a collaborative mindset

Establishing the bridging facility has been a challenging experience, but Elisabeth and Drew are drawing on the skills they honed at LSE to overcome key hurdles.

The most pressing challenge is working with diverse stakeholders around the world, from government agencies to local capital providers and their portfolio businesses.

“When you have multiple stakeholders, the biggest challenge is establishing a common sense of what the problem is,” Drew reflects.

On the EGMiM, working with a diverse, international cohort helped them prepare for this kind of collaborative challenge.

EGMiM students also have the chance to visit Beijing and Bangalore, further expanding their knowledge of the global business landscape.

“Having that variety of perspectives and ways of thinking was amazing,” Elisabeth recalls.

Equipped with these insights, Elisabeth and Drew are optimistic that their bridging fund will be a success, and create a roadmap for addressing funding issues in the future.

“We have an opportunity to use this crisis to make material changes. We’ve seen Covid create a sense of urgency to resolve global issues,” Drew concludes.