Venture capital companies offer generous salaries, international travel, and the chance to work with some of the world’s most exciting startups. In fact, VC professionals can be the difference between a company making it or not. Facebook, Google, and Twitter were all backed by VC firms.

That’s why VCs hire from the best global business schools. Pursuing an MBA—building your general management skills, getting exposed to various industries and functional areas, and building a global network—can set you up for VC success.

How do you go from an MBA to a job at a top VC firm? What’s working in the VC world really like? What’s different about VC firms in China?

BusinessBecause spoke to Tsinghua Global MBA alumni from Tsinghua University School of Economics and Management (SEM), where the top VC firms hire from each year, to find out.

5 Things You Need To Know About MBA Jobs In Venture Capital

1. What is venture capital?

Venture capital firms invest in early-stage startups they think have the potential to be a success and offer a good return on investment. If you were one of the early VC investors in Facebook, you’d be very rich by now.

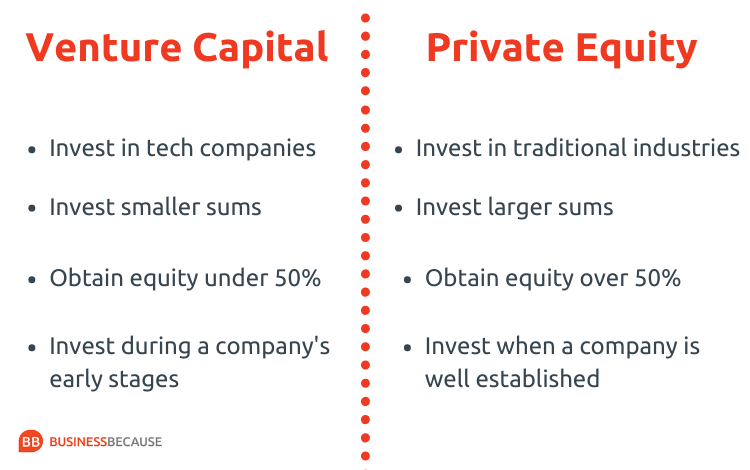

VC firms invest at an earlier stage than private equity firms. They also offer technical and managerial expertise and mentorship to the startup entrepreneurs. To raise money for investment, VC firms open a fund and ask for commitments from partners.

Yutong Gu landed a senior associate job at ChinaEquity Group—which was rated as one of the top 25 VC firms in China by Forbes in 2015 and has an AUM (assets under management) of over $3 billion—after his MBA at Tsinghua.

He manages an investment fund focused on the mobility industry. This involves spending time with companies to conduct due diligence—interviewing customers, suppliers, and management—before presenting an investment recommendation back to the firm’s investment committee. They then decide whether to approve the investment.

While VC and private equity firms are more clearly-defined in the US, in China PE firms are less common, Yutong explains. Western PEs mostly borrow from banks to make investments—this is called a ‘leveraged buyout’—but this doesn’t happen in China, he says.

Chinese VC firms therefore invest in later-stage companies than their US equivalents. Yutong says he even invests in some close to IPO-stage companies. After an IPO, or Initial Public Offering, private companies are listed on the stock exchange for public investment.

Whereas in the US most firms making VC investments have a similar structure, in China three types of companies do VC investment: privately-owned Chinese companies; foreign-owned companies; and state-owned firms.

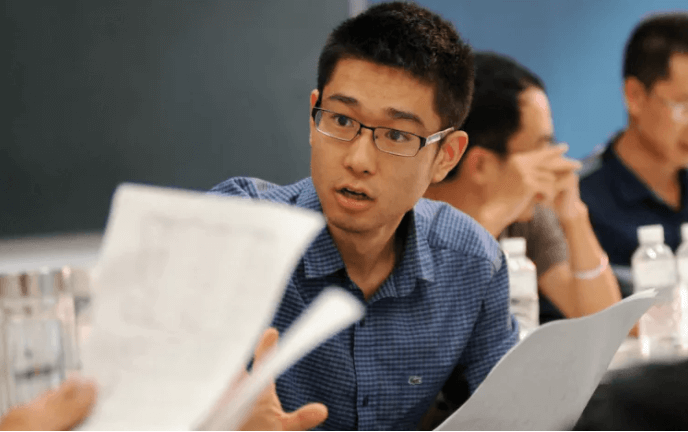

Yutong Gu got a VC job at ChinaEquity Group after the Tsinghua MBA

2. What are the world’s best VC firms?

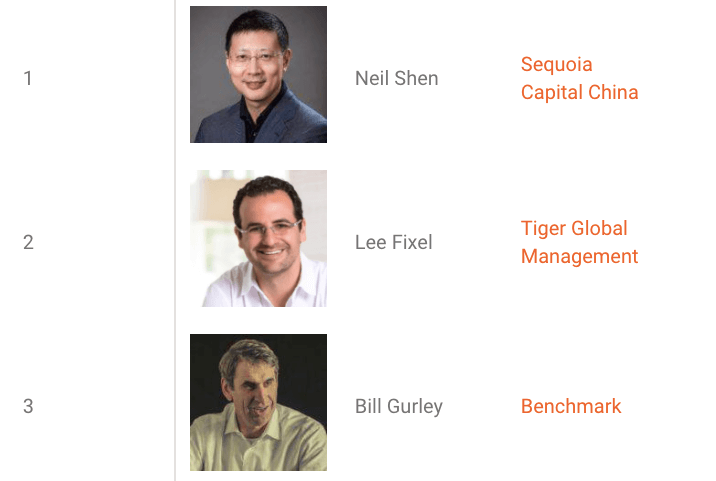

The world’s best VC firms are home to the world’s best venture capitalists. These include Neil Shen, founding partner at Sequoia Capital China; Lee Fixel, founding partner at Tiger Global Management; and Bill Gurley, general partner at Benchmark.

Many of the leading VC firms are located in San Francisco’s Silicon Valley, the world’s foremost tech startup hub. However, in the past decades, China has risen to become the second biggest market for venture capital in the world after the US.

Some of the most active VC investors in China were once VC-funded startups themselves—like Alibaba, Baidu, and Tencent Holdings—while top US VCs like Sequoia Capital are very active in China.

The top three venture capitalists in the world according to CB Insights

Saman Farid (pictured) has worked for top VC firms across the US and China. He’s now a partner and head of the US team at Baidu Ventures, investing in the world’s hottest artificial intelligence startups.

He says it was during his MBA at Tsinghua that he was first introduced to venture capital, interning at a VC firm after his first year. After graduation, he joined Chinese VC firm Legend Holdings and went on to spearhead its investment efforts in the US.

Saman even set up his own investment company, Comet Labs—raising $50 million and investing in 80 startups—before joining Baidu.

As a former engineer, he says the Tsinghua MBA gave him the core business knowledge—how to read a balance sheet; how to do accounting; basic management techniques and the theories and philosophy behind them—needed to become a successful venture capitalist.

“[The MBA] is absolutely critical to what I do now,” he says.

3. What VC jobs are there for MBA graduates?

While structures vary by firm, the typical promotion route in a VC is:

Analyst. Your job is to crunch the numbers and research potential investments.

Associate - Senior Associate. Source new deals and manage the investment portfolio. MBA grads usually come in at associate or senior associate level.

Principal or Vice President. Oversee and sit on the board of several portfolio companies. Negotiate terms of acquisitions.

Partner - Senior or General Partner. Raise and manage venture funds, set and make investment decisions, and help portfolio companies exit.

Whatever level you’re at, VC jobs come with impressive salaries. An analyst at a top US firm could expect to earn an annual salary of between $60,000 and $100,000, while MBA grads working in associate roles can earn between $100,000 to $200,000, and salaries increase exponentially as you make your way up the VC ladder.

Wilson (center) used his MBA experience to discover his passion for venture capital

Like many Tsinghua MBAs, Wilson Wu found his first job in venture capital after business school, joining WI Harper, one of the first US VC funds to invest in Greater China. As vice president, Wilson raises funds, finds promising startups, makes investment decisions, and travels between offices in Beijing, Taipei, and his base in Silicon Valley.

Getting a VC job is not easy, he says. VC firms are small and don’t hire often. However, having an MBA is a door-opener. Out of Wilson’s class of 100 MBA students at Tsinghua, around 30 now work in the investment sector. “When there’s information I need on a company that I cannot find publicly, I dig into that network,” he says.

MBAs have even started their own VC firms—like Tsinghua MBA James Tan, founder of Quest Ventures, a multimillion dollar VC fund focused on tech startups in Asia. James manages a portfolio of 50 companies in over 150 cities across the continent. In 2019, he began raising two new funds totaling up to $120 million, focused on the Asia market.

“To be able to go into a new market like China and to tap into its ecosystem, I could not have done it without the people I met at Tsinghua,” he says.

James Tan started venture capital firm Quest Ventures after his MBA

4. What do VC firms look for in their MBA hires?

Four things are helpful when applying for jobs in VCs, says Yutong, from ChinaEquity Group:

1. Brand names on your CV

The VC industry looks for brand names. Having reputable universities and established companies on your CV can help.

2. Hard skills

An MBA is about developing yourself as a leader as well as honing your technical skills in accounting and finance. In fact, everything you do during an MBA is used in venture capital, Yutong explains, from strategic thinking to financial management and market research.

3. Entrepreneurial mindset

To work in VCs, you have to think like an entrepreneur; to understand the startup process, the needs and wants of the startup founders, and the challenges they face. Yutong says the Managerial Thinking and Communications class at Tsinghua—one of the MBA’s core soft skills classes—taught him to communicate with entrepreneurs.

4. Network

The VC industry is more collaborative than you might think. Having a global MBA alumni network to tap into can help you when assessing market opportunities across industries.

Anna Lee completed a dual degree at Tsinghua and MIT to accelerate her VC career

Fellow Tsinghua alum Anna Lee knows more than most what it takes to land a VC job. Even before her MBA she worked as an analyst at IDG Capital. One-in-two Chinese unicorns—companies valued at over $1 billion—have been funded by IDG.

After graduating, she moved from research work to helping IDG open a Korean office, and now works to help Korean investors and companies expand into China. To work for VCs, Anna says, you have to offer something unique; “something that makes you special.”

Anna completed the Tsinghua MBA-MIT Master of Science in Management Studies (MSMS) dual degree program—one of several dual degree programs on offer to Tsinghua MBAs—spending her first year at Tsinghua in Beijing and her second at MIT. The experience gave her a wider global network and in-depth knowledge of business culture in both East and West, she says.

When applying for VC jobs, you’re not at a disadvantage if you come from a non-finance background, Anna continues. “If you have a background in engineering or healthcare, for example, that can also make you special for a VC.”

5. What’s it really like working in venture capital?

Five-star hotels, first-class travel, and working with top entrepreneurs; venture capital is seen as a sexy industry, but life in a VC firm is tough.

You’re constantly learning—about new trends, new markets, and new deals—building up knowledge of new industries. You have to make difficult decisions—removing founders, changing CEOs, having the fate of companies in your hands.

Things can also change quickly. China suffered a huge slowdown in VC activity after its coronavirus outbreak, but it recovered fast too with startups raising more than $2.5 billion in March 2020.

“You have to keep up with this rate of change,” explains Yutong. “You have to be on call and available all the time,” he continues. “Even on weekends or holidays, if someone calls you, you have to switch into work mode.”

For some students, the Tsinghua MBA is the perfect preparation for a job in venture capital

Wilson from WI Harper loves the high-octane life of a venture capitalist. “There’s no breaks. We meet companies during the day; write reports at night; work on the weekend.” It’s something, he says, that only an intensive MBA program at a school like Tsinghua can prepare you for.

There’s still a lot out of his control. Most startups fail. “Finding that company that’s going to make you a lot of money is like winning the lottery; it doesn’t happen every day,” he says.

But it’s that lottery, and the chance to work in one of world’s most exciting industries, that keeps MBA students coming back for more.