According to our BusinessBecause Cost of MBA Report 2022, the overall average cost of pursuing one of the world’s top MBA programs is $189,000.

Although the salary returns, network, skills, and experience make the initial investment well worth it, it’s a good idea to stick to a budget, and cut costs where you can.

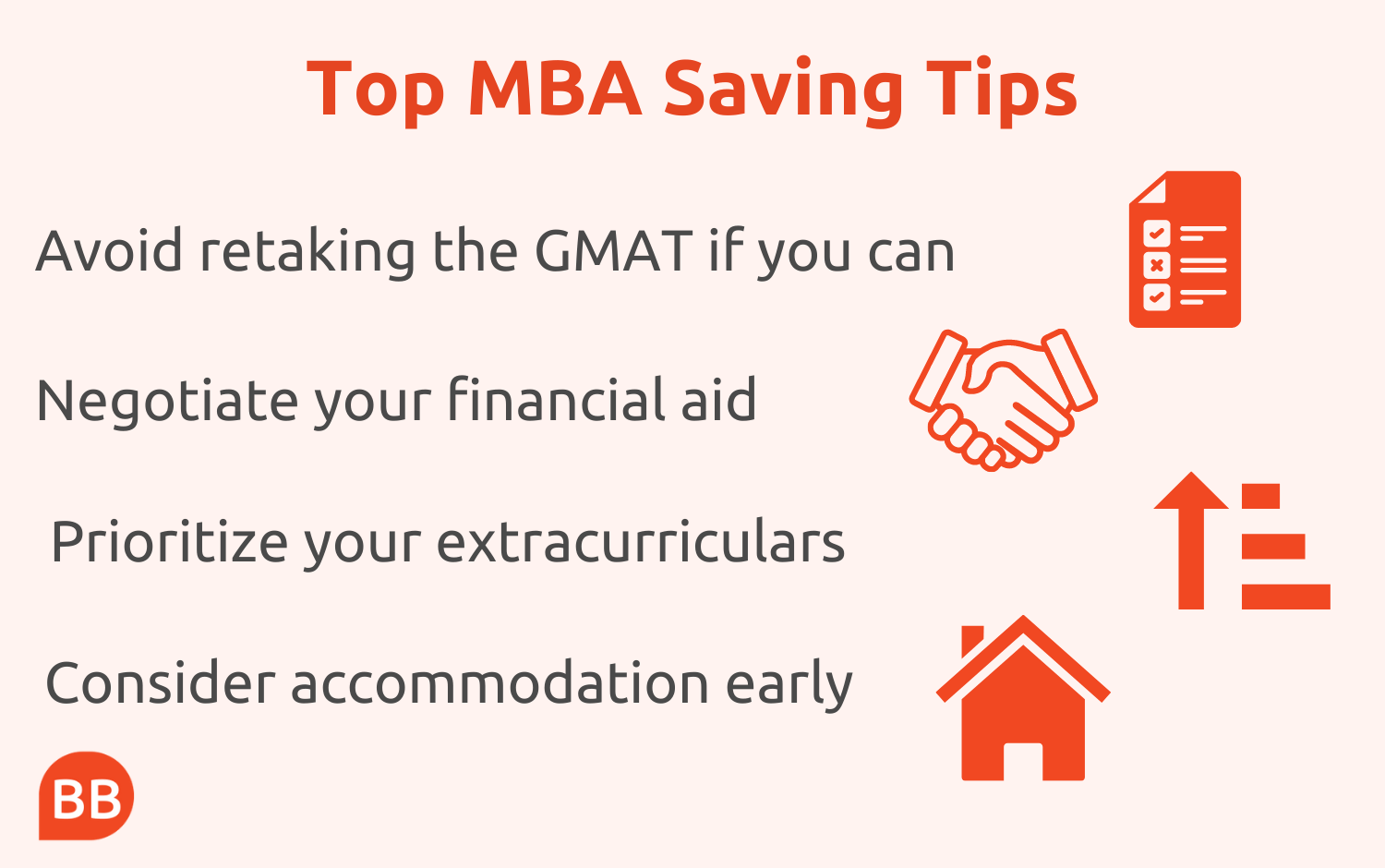

Here are six money-saving tips from MBA students, grads, and experts to help you get the most out of your business school experience without going over budget.

Money Saving Tips For MBA Applicants

1. Save money on the GMAT

You can save money before you even start your MBA by making sure you’ve adequately prepared for the GMAT.

“Each GMAT attempt costs money, time, and energy. Therefore it pays to begin preparations early, so you can hopefully achieve your target score on your first attempt,” says Wei Xiang Low (right), a recent MBA grad who studied at INSEAD Singapore.

A high GMAT score can also put you in a better position when it comes to eligibility for financial aid

“If you can raise your GMAT score by 30 points, you might secure another $30k in scholarship money,” adds David White, founding partner of admissions consultancy, Menlo Coaching.

2. Maximize your MBA scholarship and loan opportunities

Since tuition is the single biggest cost you’ll need to cover at business school, it’s important to apply to every scholarship and financial award you’re eligible for.

“Make sure you try to negotiate your financial award letter,” adds Chris Abkarians, an MBA graduate from Harvard Business School and co-founder of MBA loans company Juno.

“A lot of schools have some money left in the budget to win you over but most people don’t negotiate—and if you’re not doing it, somebody else is.”

If you’re funding your MBA with loans alongside or instead of scholarships, you also have the power to drive a bigger deal. Chris’ own organization, Juno, negotiates on behalf of large groups of candidates to negotiate for the lowest private student loan interest rates on the market.

It’s worth shopping around for such novel approaches to MBA loans that might save you money in the long run. Stepex, for instance, offers future earnings agreements (FEAs), which see grads agree to pay back a fixed percentage of their post-MBA salary for a fixed number of years, rather than making repayments based on an interest rate.

3. Secure your business school accommodation early

If your MBA program requires you to relocate somewhere new, chances are accommodation will make up the bulk of your living expenses—especially if you’re studying in a region with high living costs.

To get around these high price-tags, securing your accommodation early is key.

“Affordable accommodation near campus tends to get snapped up quickly,” explains Wei. “As soon as you’re accepted into a program, make your accommodation search a top priority.”

You might also consider sharing a house or apartment with other members of your cohort to split the cost, or living a little further from campus.

“If you’re willing to live without some perks such as in unit laundry, you can find really affordable housing on Craigslist or in smaller, older buildings,” adds Nicole Cuervo, an MBA student at Northwestern University’s Kellogg School of Management.

4. Buy second-hand MBA books and materials

When you’re stocking up on study essentials, you can also make some serious savings if you’re willing to forego brand new items.

“Look out for second-hand furniture or textbooks, especially from seniors,” recommends Wei. “It may be as good as new!”

If you need to upgrade your computer or laptop prior to study, going pre-used is also a savvy option. Many manufacturers, including Apple, sell refurbished products that work like new but cost a fraction of their original price.

5. Accept you can’t do everything during your MBA

Taking part in extracurricular activities is a crucial component of an MBA for many students. But whether it’s international exchanges, company visits, or networking trips, costs can quickly spiral—and saying yes to every opportunity that comes your way might not be feasible.

“You should have a good idea of what you can afford to miss out on,” suggests Ena Oghenekaro Oru, an MBA student at MIT Sloan School of Management.

“But since experiential learning is a big part of most programs, prioritize the trips that will be most beneficial to you.”

Informal activities like lunches, socials, and student-led trips can also bring hidden MBA costs. Fortunately, there are plenty of ways to socialize with your new connections without breaking the bank, such as potluck dinners, free activities like local walks, and game nights.

“Consider investing in a good coffee or a few nice teas and having people over for tea, coffee, or lunch,” Nicole advises. “You’ll save money, and they’ll appreciate being invited over.”

6. Request an additional post-MBA signing bonus

Great news! You’re halfway through your summer MBA internship and you’ve been offered a full-time job.

To put yourself in the best possible financial position and cover some of your tuition for your second year, you could try requesting an additional signing bonus to be paid out ahead of your start date.

“I’ve seen a few dozen people successfully request and receive an additional signing bonus to help with tuition,” reveals Chris from Juno. “As long as you’re polite, your leverage is greater than you think.”

Download our Cost of MBA Report 2022

RECAPTHA :

50

6d

3b

51