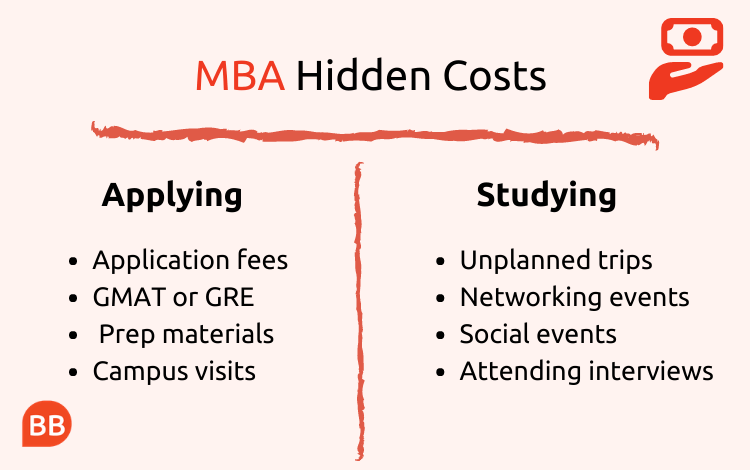

Pursuing an MBA is a significant investment, and along with the costs you might expect—like tuition and housing—come other, hidden expenses.

While the skills, network, and salary boost you’ll gain from a good MBA program will help you recoup your investment over time, understanding exactly how much you should budget for business school is vital.

According to the BusinessBecause Cost of an MBA Report 2021, pursuing a top-ranked MBA program will set you back around $176,000 on average. This figure includes healthcare and living costs along with tuition and fees, but while this is a reliable estimate, it can’t cover everything.

From the application process right up to graduation, here are four hidden expenses you might encounter when pursuing an MBA:

1. Applying for an MBA

$500+

Going to business school can be a pricey decision before you even set foot on campus. Depending on how many programs you apply to, and which resources you choose to make use of, the application process can quickly add up to hundreds, or sometimes a thousand, dollars.

Most schools charge an application fee, which will typically range from $80 to $250. On top of this, most schools require you to take a standardized admissions test like the GRE or GMAT.

Sitting one of these exams will set you back about $200, and chances are you’ll need to set aside $100 more to purchase the best prep materials.

Some applicants may also choose to hire an admissions consultant—someone with expert knowledge who can coach you through the application process and improve your chances of being accepted.

The prices charged by consultants vary considerably, but can be as much as $500 per hour.

To avoid being caught out by these expenses, preparation is key. Ideally, you should try to sit the GMAT or GRE only once, and apply to just a few carefully considered programs where you have a good shot at being accepted. Some schools also offer fee waivers to certain applicants.

2. Trips and visits

$10,000+

Once you make it to campus, the hidden costs continue—unplanned trips and visits are the largest expense you’ll likely encounter.

Along with trips planned by the school, you’ll no doubt find yourself invited to supplementary experiences arranged by peers.

“Someone once told me the difference between a good MBA experience and a great MBA experience is about $10,000,” quips Nishant Store, a current MBA student at INSEAD in France.

With a background in risk management, Nishant is using the MBA to jump out of his niche, and gain a broader perspective while exploring new career opportunities.

“A lot of the unexpected costs you’ll encounter during an MBA are discretionary—such as going on a few extra trips with friends during the year,” he notes.

A Bloomburg study backs this up. In 2015, it found, the average Columbia MBA spent $14,400 on optional activities.

For many students, these extra trips are an essential part of the MBA experience, so it’s a good idea to allow for a hypothetical trip or two when planning your business school budget.

Because the MBA experience lasts for only a year or so, Nishant recommends choosing cheaper accommodation, and funneling the money you save into supplementary activities.

Planning and prioritization is once again key. Try to arrange extra trips with your peers as far in advance as possible, and agree on a budget early on to ensure that everyone is on the same page.

3. Networking and socializing

$5,000+

Networking is something of a buzz word when it comes to business school. Being able to learn from your peers, and gain insights from alumni across countries and industries, is a crucial part of the MBA experience. But useful conversations don’t always happen in the classroom.

To really gel with your cohort and alumni, you’ll probably want to take part in social activities, whether that’s grabbing a coffee, visiting a museum, or playing a round of minigolf. Assuming you spend just $50 per week on these activities on average, your expenses add to to $5,000 or more over a two year program.

Informal activities like these are a good way to blow off steam during what can be an intense and challenging time, but it’s easy for costs to spiral without careful planning.

“Foregoing your income and sticking to a pre-planned budget for one or two years is an exercise in both faith and self-discipline,” reflects Mtha Moses, an MBA student at CEIBS in China.

Mtha is originally from South Africa, where he began his career in product development. He chose the CEIBS MBA to broaden his business acumen in a new and diverse environment.

To stay abreast of social costs, he recommends hedging against uncertainty, by keeping your savings readily accessible. You could also consider a few low-cost activities—like a potluck dinner or board game night—to prevent costs from mounting up.

4. Internships and job hunting

$1,000+

As graduation approaches, taking your next career step can also throw unexpected costs your way. Whether travelling for interviews, attending networking events, or foregoing paid work while you seek the perfect opportunity, career development could cost you $1,000 or more, depending on where you travel.

“You might want to fly out to meet a company at one of their local offices, for example,” notes Nishan, “or travel to a few different locations for a few different interviews.”

Once you land an internship or permanent role, costs such as updating your professional wardrobe and socializing with new colleagues can also add up, which might pose issues in your first weeks if you aren’t offered a signing bonus.

Surprising costs like these can reveal themselves at virtually every stage of your MBA, but with careful planning you can make sure you aren’t caught off-guard.

Ensuring you have access to emergency savings and finding a few areas to cut costs can ease the financial strain that is, for now, part and parcel of the MBA experience.