You might think digitization in the finance sector means fewer jobs, but the stats tell a different story. 75% of financial services organizations are creating jobs related to financial technology, or fintech, and an overwhelming majority of firms are keen to expand their workforce over the next year.

Many of these firms will look to the tech sector for hires, but progression in the sector takes more than specialist computer skills.

As a software developer for various tech-driven trading firms, James Jahnke, an American graduate of the HKUST-NYU Stern Master of Science in Global Finance (MSGF), says his career success comes from combining his technical skills with a strong foundation in finance and management.

Why a Master's in Finance?

Though many use a Master’s in Finance in order to switch into finance, James Jahnke already had 14 years’ experience in the sector, as a software developer for the Chicago Trading Company.

He was well-versed in options markets, which were the main focus of his work, but he felt a broader foundation in finance and management would be useful in helping him converse more easily with staff across departments.

“I always thought about going back and getting an MBA” adds James, but the sector-specific modules of a Master’s in Finance proved more attractive in the end.

“The MSGF program was the most well rounded,” he explains, “and it didn't have all the fluff of a typical MBA program. It was all technical, science-related courses, which I really liked.”

Given his firm was international, with offices in the APAC region, the travel opportunities on offer on the HKUST-NYU Stern MSGF were also a big plus, providing a unique chance for James to develop an international network.

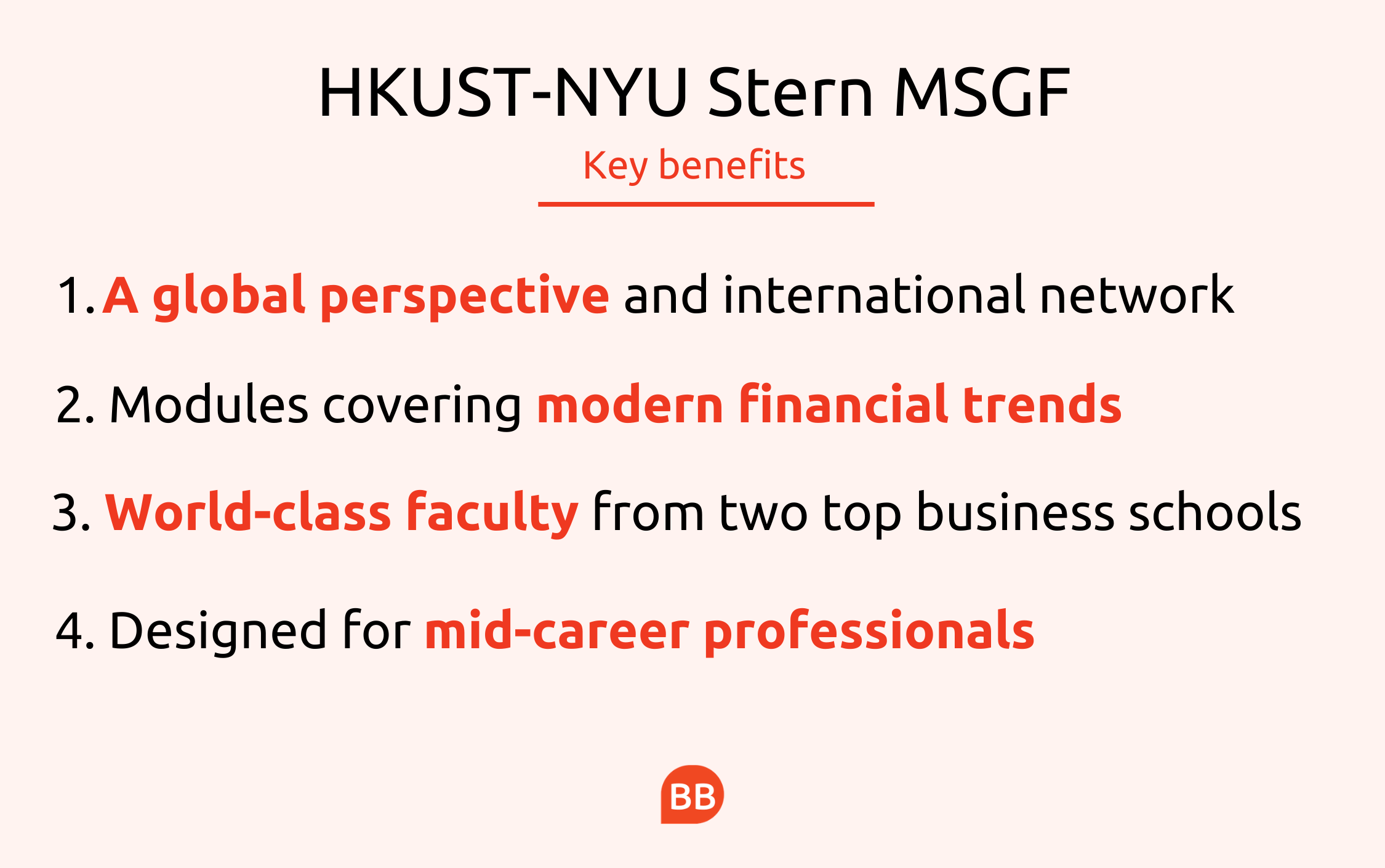

The MSGF is a joint collaboration between Hong Kong’s HKUST Business School and NYU Stern and students on the program take classes in three of the world’s financial centers: New York, Shanghai and Hong Kong.

Highlights of the MSGF program

The HKUST-NYU Stern MSGF is geared towards more experienced, mid-career professionals—the class has an average of 12 years’ experience between them. James says some of the program’s specialist modules were challenging at first.

“Coming from a computer science background, a lot of the topics were very new,” he says. “A lot of the options work was easy, due to my job, but in other subjects I just had no experience.”

It was this range of tougher modules, covering modern trends in the sector such as fintech and behavioral finance, that helped James develop the stronger foundation in finance he needed to accelerate his career.

The program also focused on team problem solving projects, where students from a variety of backgrounds collaborate to work on real-life finance issues.

This interactive approach encourages learning, not only from top faculty members from HKUST and NYU Stern, but between the students who come from a range of backgrounds and can share their unique perspectives.

“It was challenging, but well worth it,” James reflects. “The course wouldn’t be the same without it.

“The MSGF was a way to be able to see the world, and different markets, through other people's eyes. And I came out of the program with some lifelong friendships.”

MSGF Career Benefits

Though many use the MSGF to pivot into a new career, James used his experience to accelerate his established career as a software developer, and has now moved to a larger international trading firm, IMC.

With a stronger grounding in finance thanks to his master’s, James is now able to communicate about the wider financial world outside the United States in a more meaningful way.

“I’m in a similar role to before,” James remarks, “but with more responsibilities. There's more interfacing with the business side with the traders and the analysts.

“The MSGF gave me the tools to really understand the markets, and what actually drives stock prices and option prices. It’s definitely helped me be able to hold those kinds of conversations.”