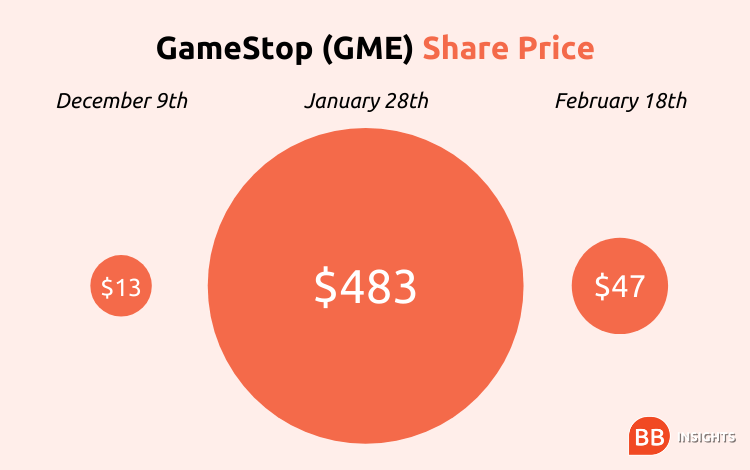

As a company that had reported nine figure losses in 2020, few would have staked their money behind failing high-street gaming retailer, GameStop. So, when GameStop’s share price peaked at $483 in late January, everyone from Wall Street stalwarts to amateur traders and regulators paid attention.

Behind the GameStop saga you’ll find a tale as old as time: an angry mob taking on the establishment. Or to be exact, an outsider community of amateur traders—Wall Street Bets—taking on the stock market, and, to some extent, winning.

So will GameStop be a one-off, or could this be the start of a new impact investing social movement?

What happened with GameStop?

To understand the GameStop saga, you have to understand short selling.

Short selling is essentially betting on the price of a share to go down. Short sellers borrow stocks off brokers, sell them quickly, then buy them back when the price has fallen, returning them to the broker and pocketing the price difference. It can be risky—if the price of the share rises instead, then the short sellers have to buy it back at a greater price, thus making a loss on their short position.

Investment management company, Melvin Capital, and other funds identified an opportunity to short GameStop stock, a move that made sense based on the company’s performance, explains Daniel Haguet, professor of finance at EDHEC Business School.

“GameStop is not a good stock. If GameStop is losing money, the stock is going down, so it makes sense that the strategy of hedge funds is to short sell the stock,” he says.

Meanwhile an informal investment community called Wall Street Bets, based on social media site Reddit, watched on with disdain. An idea emerged that if enough people bought GameStop stock, then the share price would rise instead of fall, and the hedge funds betting on the share price to drop could lose billions in the process. This is what’s known as a short squeeze.

The movement grew quickly. GameStop’s share price ballooned in a matter of days. The share price peaked at $483 a share—for reference, Apple currently trades at around $135 a share.

MIT Sloan finance professor Andrew Lo believes social media was a critical factor.

“Interaction on the Wall Street Bets Reddit channel provides a certain opportunity to mobilize a much larger group of investors and capital that didn't exist before,” Andrew explains.

Social media wasn’t the only technological factor at play. Day trading—the quick buying and selling of financial instruments over the course of a day—has taken off through apps like Robinhood and eToro. Just with other online trends like TikTok and eSports, the COVID-19 pandemic has propelled online trading activity—eToro saw a 427% increase in users in the first three months of 2020.

In a sense, it worked. Hedge funds reported losing their short position: while numbers aren’t public, expected losses are in the billions.

A new ‘social movement’?

After GameStop’s share value peaked many shareholders started selling off their stocks, causing the price to quickly fall back down. At time of writing, GameStop sits at around $47 a share.

Johan Hombert, professor of finance at HEC Paris, believes that day trading may have had its day. Ultimately, short term trading is a zero-sum game.

“When one of the traders is an individual investor and the other trader is a hedge fund, guess what happens. Hedge funds have more resources and better information, so they are better able to predict short-term movements in stock prices,” he says. “As a result, more often than not, retail day traders' losses are hedge funds' gains."

Daniel from EDHEC is equally skeptical about the longevity of what he dubs ‘noise trading’. “In this instance, following the herd was good. But in some cases, it is better not to follow the herd. Beware of the herd.”

Murmurs of the start of a social movement have weight. We’ve seen forms of populism and collective action on the rise in recent years, propelled by social media: could this be a similar movement using financial instruments instead of ballot papers and protests?

“Populism and anger at the establishment have brought extreme elements into politics, and this is another extreme manifestation of that,” Andrew says. “We need to pay attention to this.”

The power of impacting investing

In many ways, what happened was no different to impact investing—using investment to make a political or social statement.

“GameStop is an example of the ultimate impact investing,” Andrew says. “A bunch of investors got really angry about short sales of a company they really cared about, they acted, and got the impact they were looking for.”

This leaves GameStop investors in a grey zone, one which is currently undefined by regulators and policy makers. Should they be praised for using investment to cause a type of social change, or punished for manipulating share value? And how can regulating bodies, like the Securities and Exchange Commission (SEC), distinguish the two?

“The SEC needs to come up with regulatory guidelines around activities that are considered manipulative and destabilizing, versus those that are laudable ways of investors to vote with their dollars,” thinks Andrew.

Do we need better regulation?

Social media communities present a new source of risk and instability for financial markets.

“Hedge funds, institutional investors, and portfolio managers will now have to incorporate these social movements as sources of potential risk for their positions,” Andrew from MIT says.

There have been calls from figures like Elon Musk to ban the practice of short selling. He argued it was the source of instability in the first place.

Daniel from EDHEC disagrees and warns against banning short selling: a tactic tested in France and Germany after the 2008 financial crisis. “Short selling brings liquidity to financial markets, it's a self-regulation of the markets. If you ban it, you cut a source of liquidity on the market, so volatility is much higher.”

Many on Wall Street have called for better regulation to limit this sort of risk. Collusion between institutional investors and funds to manipulate a stock price would normally be grounds for criminal penalties, let alone regulatory intervention, Andrew says.

Yet this was a disparate group of amateur traders—the equivalent of someone getting a megaphone out at a football game and telling everyone to buy GameStop stocks.

Regulation would require great intervention on the part of social media companies—a separate and equally complicated ethical debate in itself.

Either way, the GameStop saga has left an impression. Wall Street Bets’ Reddit channel, at time of writing, has nearly nine million followers. Where they focus their energy and money next is anyone’s guess. But if their intention was to grab Wall Street and the establishment’s attention, then they’ve succeeded.

Read next:

Robinhood, eToro, & The Other Hottest Apps To Look Out For In 2021

BB Insights explores the latest research and trends from the business school classroom, drawing on the expertise of world-leading professors to inspire and inform current and future leaders