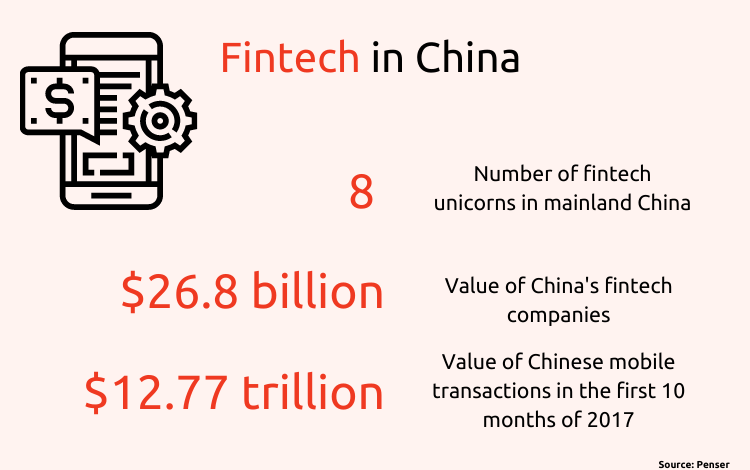

China is home to a fintech sector worth over $25 billion. Rapid advancements in technology have allowed fintech applications, from digital payments to automated underwriting, to thrive, disrupting traditional finance in the country.

According to PwC, 68% of Chinese financial services companies expect to increase fintech partnerships over the next five years.

All these developments are creating a demand for ambitious finance professionals, but in order to thrive, you will need a strong awareness of China’s unique financial landscape.

Below are three important things you should know before launching your fintech career in China.

1. The coronavirus pandemic has accelerated China’s fintech development

Since the coronavirus pandemic began earlier this year, the temporary closure of brick-and-mortar banks—along with health warnings about the transmission risk of paying with cash—has triggered a shift toward digital solutions.

The pandemic caused a year-on-year increase in real-time mobile payments of almost 5%, while ecommerce sites also saw a boost as China’s urban population was instructed to stay at home where possible. Even as the worst effects of the pandemic slow, many organizations expect work from home practices to continue.

Chinese fintech firms are well placed to help consumers and businesses conduct more of their transactions remotely. As demand for these fintech services rises, a new wave of tech-savvy finance professionals will be needed to fill emerging roles, and China’s top business schools are poised to bridge this gap.

At Beijing’s Cheung Kong Graduate School of Business (CKGSB), for example, MBA students with a flair for finance are prepared to make their mark on this quickly-changing sector.

Through modules like Quantitative Investment and Fintech, students are exposed to a wide range of fintech applications, including the latest innovations.

Fintech is an incredibly valuable industry in China. Source: Penser

2. China hosts more fintech unicorns than any other country

China’s fintech landscape boasts more unicorns (startups valued at one billion US dollars or more) than anywhere else.

Mainland China alone hosts eight leading fintech unicorns, including the world’s highest valued fintech company: Ant Group. The organization operates Alipay, the world’s largest online payment platform, Yu’e Bao, the world’s largest money-market fund, and Sesame Credit, a third-party credit rating system.

Other impressive fintech unicorns in China include global ecommerce platform, PingPong, and small business lender Magnet Finance.

Attending a Chinese business school can help you connect with these organizations. CKGSB in particular is known for its powerful network of Chinese business leaders, with 25% of China’s most valuable brands being run by CKGSB alumni.

The school also has fintech recruiting partners including JD.com, which operates fintech solutions arm JD Finance, and Tencent, which operates leading online payment platform, Tenpay.

To find a role with one of these relatively small but hugely disruptive companies requires an open mind and innovative outlook. Fortunately, leading Chinese business schools are stepping in to help their students develop this mindset.

On the MBA program at CKGSB, students are exposed to innovation strategy in China through experiences like the China Module. This two week program is designed to give participants expert insight into China’s business landscape, through lectures like “Entrepreneurship and Innovation in China,” and “Business Model Innovation in the Digital Era.”

3. The next wave of Chinese fintech disruption will rely on AI

As fintech applications continue to develop in China, artificial intelligence (AI) is expected to be widely adopted. This kind of AI innovation is spurred by the Chinese government, which offers significant tax incentives for companies conducting research and development in AI.

AI technology is already being used to assist with underwriting, tackling fraud, and customer service. It has been especially useful for small Chinese businesses hoping to access credit.

Online lenders like Alibaba-backed MYbank, and Tencent-backed WeBank, are set to play a greater role for China’s estimated 38 millions SMEs (small to medium enterprises). According to research from Webank, 80% of these companies do not have credit with a bank, largely due to their lack of traditional credit history.

Webank and similar lenders use AI to ascertain whether applicants should receive a loan or not, using a ‘soft’ credit check that gathers data on customers’ ecommerce and social media history.

Studying an MBA in China is a great way to develop an in-depth understanding of these trends, and how the technology behind them functions.

At CKGSB, for instance, MBA faculty have ample experience in both tech and finance. Professor Li Yang specializes in machine learning and big data, for instance, while Professor Li Wei is an expert in macroeconomics and financial markets.

Having access to experts with local experience has helped 81% of MBA alumni to land jobs in China after they graduate.

The main image in this article is credited to © Danielinblue, and used under this license